在亚马逊丛林深处全球最大的铁矿卡拉加斯(Carajás),大量红土被挖出地面,它们即将穿越半个地球,运抵中国东部沿海的钢铁厂。在那里,它们摇身一变,成为数百个繁荣发展的中国城市里上百万高层建筑的钢筋支柱。

去年,中国超越美国,成为巴西最大的贸易伙伴。这两大发展中国家或许坐落于地球的两端,但过去十年,它们之间日益密切的经济纽带已经成为全球经济格局演变最长久的象征之一。

同时,这两大发展中国家或许正在开辟一条全新道路,有可能成为未来十年规模最大的全球经济结构调整之一。尽管宣传低调,但今年中国有望成为巴西最大的直接投资者。前不久中巴两国宣布了一系列合作协议,涉及领域包括矿产、钢铁、建筑设备与电力输送。

这些投资是一个酝酿缓慢但极其重要的趋势的一部分。刚刚超越日本、成为世界第二大经济体的中国,正逐渐成为亚洲以及其它发展中国家新一轮自我持续经济发展周期的支柱——这是一个绕开欧美经济体的发展周期。

中国不仅正像其过去十年一直在做的那样,从其它发展中经济体大量购买原材料,而且还开始在这些国家进行基建和实业投资,其中部分投资项目之所以成为可能,要归功于中国的制造业企业报价优惠、日益成熟、以及中国能够开出极具诱惑力的财务条件。中国政府以这种方式在部分非洲国家投资已经有些年头:如今类似的交易正在推广至全球。对许多发展中国家而言,中国经济繁荣的冲击正形成一个完整的循环。

"这是一个新周期的开始,"苏格兰皇家银行(RBS)经济学家贝哲民(Ben Simpfendorfer)表示,他的著作《新丝路》(The New Silk Road)剖析了中国与中东、中亚以及南亚迅速发展的经济联系。"中国有愿意投资的企业,他们的产品质量足够好,而且还得到本国金融体系充裕流动性的支持。"

欧亚咨询(Eurasia)总裁、《自由市场终结》(The End of the Free Market)作者伊恩•布雷默(Ian Bremmer)表示,这场由中国引领的与西方脱钩的过程绝非偶然。他称这是一项战略,旨在降低对美国的经济依赖、以及一定程度的政治依赖。

"这是一项意图明确的政策,在中国整个领导层的议程上是重中之重,"他说道。"他们正在寻求一种对冲战略,因为他们对于发达国家的长期经济前景没有把握。"

布雷默认为,促进自主创新和刺激国内消费也是该战略的一部分,但增强与其它发展中国家的经济融合则属于"一个能够迅速实现的战略"。

在巴西,脱钩过程造成的冲击感觉最为强烈。

过去十年,随着对华贸易蓬勃发展,巴西人有时会抱怨,自己的国家再次和20世纪时一样,沦为了向工业化强国提供大宗商品的角色。但在过去一年里,期待已久的一波中国投资似乎终于抵达了巴西。尽管2009年中国对巴西投资仅为9200万美元,但巴西的官方预测是今年的投资额将超过100亿美元。

举例来说,武汉钢铁集团(Wuhan Iron and Steel)斥资4亿美元收购了巴西实业家埃克•巴蒂斯塔(Eike Batista)拥有的一家矿业公司的股权,同时还计划在靠近里约热内卢的港口附近兴建一座巨大的钢铁厂。这座港口正由巴蒂斯塔的另一家公司建设。中国最大的摩托车与汽车制造商之一力帆(Lifan)公司,已经在向巴西出口大量产品。如今,公司创始人尹明善称,正考虑在巴西开设一家工厂生产汽车。"巴西是一个非常有前途的市场,幅员辽阔,国内市场庞大,"他表示。"有些中国商人太蠢了,忽视巴西的商业机会,但我没有那么傻。"

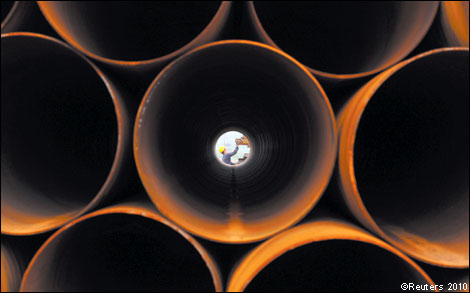

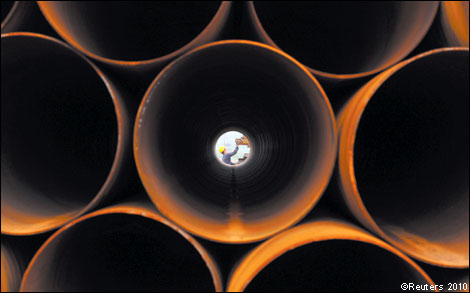

如果说,在中国与发展中国家经济交往的这个新阶段,对巴西的投资是象征之一,那么另一个象征就是全球各地如雨后春笋般出现的新铁路网络。中国铁路建设企业的效率在全球数一数二,而且在中亚和东南亚邻国开展业务已有多年。但过去一年,它们也在乌克兰、土耳其以及阿根廷等国家签订了合同,地域分布极其广泛。

中国铁路企业并没有局限于铺设铁路这一体力工作。它们希望开始签订高速铁路相关设备的海外销售合同,包括机车和信号系统。圣保罗与里约热内卢之间拟建的高铁线路有可能成为它们的第一家海外客户。

这种经济联系之所以成为可能,有两个主要因素。其一,因为中国培养出的新一代企业所生产的资本货物如今已经具有国际竞争力。它们为发展中国提供的火车、电厂、采矿机械和电信设备,质量合格,价格却常常比跨国企业低很多。

第二个因素是,中国的银行体系得到全面动员,紧随企业前进步伐,为它们提供金融支持。中国工商银行(ICBC)高管易会满最近在一次会议上表示,工行正与政府合作,在全球各地推行"铁路+融资"的服务模式。巴西亚马逊地区巨型铁矿的运营商淡水河谷(Vale)上周五宣布,与两家中国银行签署了12.3亿美元的信贷合约,为从中国一家造船厂购买12艘巨型货轮提供资金,这些货轮将用于中巴两国间的铁矿石运输。

这些交易的规模显然远远不及中国政府所持有的美国国债规模(据估计约有1.5万亿美元),但其基本动力是相同的——中国金融体系正开始循环利用其所持的部分外汇储备,将其投入发展中国家贸易伙伴的经济,以求刺激对中国商品的需求。

其影响在中国贸易数据中已经显而易见:过去一年中国面向发展中国家的出口涨幅最大。今年上半年,中国与东盟(Asean)的贸易额增长54.7%,与巴西的贸易额增长60.3%。

如果说中国投资确实开启了其他发展中国家的增长周期,那么这对全球经济而言也将是一针强心剂,如今许多主要经济体增长前景低迷,有些甚至面临二次探底的风险。来自中国的需求和不断增长的投资相结合,是上半年巴西经济得以实现8.9%这一中国式创纪录增长速度的原因之一。

然而,对于西方经济体而言,这其中还涉及许多风险。这场投资热潮可能迎来一个发达国家跨国公司与中国国有企业激烈竞争的新时代。而中国国企得到的强大财务支持也可能引发指责,称它们没有公平竞争。最近几个月,一些跨国公司——通用电气(GE)与西门子(Siemens)——对中国政府的产业政策提出了公开批评。也许不足为奇的是,它们所在行业正是中国竞争力日益强劲的行业,例如电力设备与铁路。

中国的新增实力也对美元的未来提出了疑问。中国官员曾经讨论过一个长期目标,即用一篮子货币(其中可能包含人民币)取代美元作为全球储备货币。

随着与发展中国家的贸易急速增长,中国政府也采取了一些重要举措,扩大人民币的国际应用,包括允许海外人民币资金投资离岸债券市场。一些经济学家认为在未来十年,人民币有可能成为亚洲贸易的参考货币。

然而讽刺的是,尽管人民币承担更重大国际角色的背后有着强大的经济动力,但中国政府并不希望这么做。"中国对于是否真的希望人民币全球化依然犹豫不决,"智囊机构中国社科院(Chinese Academy of Social Sciences)有影响力的经济学家余永定表示。成为重要的贸易货币是一回事,但人民币若要成为足以挑战美元地位的全球储备货币,中国政府就必须放松资本管制、开放国内债券市场。这将意味着政府放弃对汇率和利率的严密控制。

除此之外,如果要真正实现与其它发展中国家的经济融合,中国政府需要谨慎行事。一个切实存在的风险是,中国在新兴市场新发现的利益可能引发反弹,特别是如果中国制成品出口继续维持如此高速的增长的话。

现在已经出现了许多值得警惕的迹象。例如,今年印度试图缩减中国产电力设备的供应,转而向本国制造商的产品倾斜。有几个月,印度政府曾将中国电信设备制造商华为拦在印度市场之外。

在巴西,人们担心,像力帆这样的公司只会在该国组装中国生产的半成品汽车成套配件,而无意推动当地的汽车业发展。还有人担心在进入拉丁美洲其它市场方面会出现新的竞争。根据波士顿大学(Boston University)凯文•加拉格尔(Kevin Gallagher)的估算,巴西向拉丁美洲出口的制成品中,有91%将面临更廉价中国产品的竞争。如果这部分市场萎缩,巴西制造业可能会对与中国的新经济联系持更加批评的态度。

中国与其它发展中国家日益紧密的联系或许能在未来十年里为中国自己以及整个全球经济提供巨大的推动力。但保护主义浪潮也有可能中断这一进程。中国政府必须竭尽全力,确保发展中世界的新合作伙伴不会觉得被中国经济机器压垮。

译者/何黎

http://www.ftchinese.com/story/001034624

Deep in the Amazon jungle, huge chunks of red earth are torn out of the ground at Carajás, the biggest iron ore mine anywhere, to be transported halfway round the world to the steel mills on China's eastern seaboard. There they are turned into the backbone for millions of tower blocks in hundreds of booming Chinese cities.

Last year China overtook the US to become Brazil's biggest trading partner. The two large developing countries may be on opposite sides of the planet but their growing economic ties over the past decade have become among the enduring symbols of shifts in the global economy.

The duo could also be forging a path for one of the potential biggest realignments in the global economy over the next decade. With little fanfare, China is likely to emerge as the biggest direct investor in Brazil this year, following a string of deals announced in mining, steel, construction equipment and electricity transmission.

Such investments are part of a slow-burning but hugely important trend. Newly crowned the second largest economy, eclipsing Japan, China is becoming the anchor for a new cycle of self-sustaining economic development between Asia and the rest of the developing world – one that is bypassing the economies of Europe and the US.

China is not only sucking in raw materials from other developing economies, just as it has during the past decade. It is has also begun making investments in infrastructure and industry in those countries, some of which are made possible by its cut-price and increasingly sophisticated manufacturing companies or by the attractive financing terms it can offer. Beijing has for some years been investing in this way in parts of Africa: now such deals are being rolled out around the world. For many developing countries, the impact of the China boom is coming full circle.

"It is the start of a new cycle," says Ben Simpfendorfer, an economist at RBS and author of The New Silk Road, a book on the surging economic ties between China and the Middle East, Central Asia and South Asia. "China has companies that are willing to invest, they have products that are good enough, and they are backed by abundant liquidity in the country's financial system."

Ian Bremmer, president of the Eurasia consultancy and author of the recent book, The End of The Free Market, says there is no accident to this China-led process of decoupling from the west. It is, he says, a strategy to reduce economic and to some extent political dependence on the US.

"It is a very conscious policy, on the top of the agenda for the entire Chinese leadership," he says. "They are looking for a hedging strategy because they feel uncertain about the long-term economic prospects of the developed world."

Promoting innovation and stimulating domestic consumption are also part of that strategy, he argues, but pushing stronger economic integration with the rest of the developing world is the "one strategy that can be done quite quickly".

Nowhere is the impact of this process being felt more keenly than in Brazil.

As trade has boomed with China during the past decade, Brazilians have sometimes complained of being relegated once again to their 20th century role of providing commodities to the industrial powers. But in the past year, the long-awaited wave of Chinese investment in the country appears finally to have reached Brazil's shores. While it reached only $92m in 2009, the country's officials estimate that it will exceed $10bn this year.

Wuhan Iron and Steel, for instance, paid $400m for a stake in a mining company owned by Brazilian industrialist Eike Batista, and is planning to build a huge steel mill beside the port near Rio de Janeiro that another of Mr Batista's companies is constructing. Lifan, one of China's biggest manufacturers of motorcycles and cars, already exports heavily to Brazil. Now the company's founder, Yin Mingshan, says it is considering opening a plant to build cars in the country. "Brazil is a very promising market, with a vast territory and a big domestic market", he says, "Some Chinese businessmen are foolish enough to ignore doing business in Brazil but I am not that stupid."

If investment in Brazil is one symbol of this new stage of economic Chinese engagement with the developing world, another is the flurry of new rail networks taking shape globally. Chinese railway construction companies are some of the most efficient anywhere, and have for several years been operating in neighbouring countries in central Asia and south-east Asia. But in the past year they have also signed contracts in such diverse places as Ukraine, Turkey and Argentina.

Chinese companies in the sector have not restricted their activities have not been restricted to the manual task of laying rail lines. They are hoping to start signing overseas deals to sell high-speed rail equipment, including locomotives and signalling systems. The first customer could be the planned high-speed line between São Paulo and Rio de Janeiro.

There are two factors that have made these new links possible. The first is that China produced has a generation of companies making capital goods that are now internationally competitive. They can offer developing countries new trains, power stations, mining machinery and telecommunications equipment of sufficient quality at prices which are often well below those of their multinational competitors.

The second element is the financial backing from a banking system that has been mobilised to follow behind these businesses. Yi Huiman, a senior executive at Industrial and Commercial Bank of China, told a conference recently that the institution was working with the government to provide "railroads plus finance" around the world. Vale, the Brazilian company that operates the giant iron ore mine in the Amazon, announced on Friday that it had signed a $1.23bn credit with two Chinese banks to finance the purchase of 12 huge cargo ships from a Chinese shipyard, which will transport iron ore between the two countries.

The scale of these transactions is clearly much smaller than Beijing's holdings of US securities, estimated to be in the order of $1,500bn, but the underlying dynamic is the same – the Chinese financial system is starting to recycle some of its holdings of foreign currency into the economies of its developing country trading partners in order to stimulate demand for its own goods.

The impact is already apparent in China's trade statistics, with the biggest increases in exports in the past year coming from developing countries. Trade with Association of South East Asian Nations increased by 54.7 per cent in the first half of the year and with Brazil by 60.3 per cent.

If Chinese investment does indeed help kick off a growth cycle in other parts of the developing world, it will be a tonic for a global economy in which the outlook for many leading economies remains subdued, with some even facing the risk of a double-dip recession. The combination of Chinese demand and booming investment is one reason for Brazil's ability to record China-style growth rates of 8.9 per cent in the first half of the year.

Yet for western economies there are also plenty or risks involved. The investment push is likely to herald an era of intense competition between developed-world multinationals and state-owned Chinese companies. And the strong financial backing that such groups receive is likely to fuel accusations that they are not playing on a level field. It is perhaps no surprise that some of the multinationals that in recent months have publicly voiced criticisms of Beijing's industrial policies – GE and Siemens – operate in sectors in which China is becoming a fierce competitor, such as power equipment and railways.

China's new clout is also raising questions about the future of the dollar. Chinese officials have talked about a long-term goal of replacing it as the global reserve currency with a basket of others, potentially including the renminbi.

As trade with the developing world balloons, Beijing has also been taking important steps to expand the international use of the renminbi, including allowing overseas holdings of the currency to be invested in the onshore bond market. Some economists believe it could become the reference currency for Asian trade over the course of the next decade.

Yet the irony is that, while there is strong economic momentum behind the Chinese currency taking on a much larger international role, Beijing is reluctant to let this happen. "China is still very hesitant about whether it really wants the currency to be international," says Yu Yongding, an influential economist at the Chinese Academy of Social Sciences think-tank. To become an important trading currency is one thing: but to become a global reserve currency with the power to threaten the role of the dollar, the government would need to lower capital controls and open up its domestic bond market. This would mean giving up its tight control of exchange and interest rates.

Furthermore, if economic integration with other developing countries is to really take off, it will require careful management by Beijing. There is a very real risk that the new-found interest in emerging markets will provoke a backlash, especially if China's exports of manufactured goods keep up such a rapid pace of growth.

There are already plenty of warning signs. India, for instance, has tried this year to reduce supplies of Chinese power equipment in favour of goods made by local producers. For several months, New Delhi blocked Huawei, the Chinese maker of telecoms equipment, from the Indian market.

In Brazil, there are fears that companies such as carmaker Lifan want to use the country to assemble kits of nearly-completed cars made in China rather than promote a domestic industry. There is also concern about fresh competition for access to markets elsewhere in Latin America. Kevin Gallagher of Boston University calculates that 91 per cent of Brazilian exports of manufactured goods to the region are under threat from lower-priced Chinese products. If that market wilts away, industry is likely to become much more critical of the new China ties.

China's growing links with the rest of the developing world could provide a huge boost both to the country itself and to the global economy during the course of the next decade. But a wave of protectionism could yet halt the process. Beijing will need to work hard to ensure its new partners in the developing world do not feel steamrollered by the Chinese juggernaut.

Print article Email article Order reprint

没有评论:

发表评论