巴菲特旗舰公司股价被指与好莱坞影星安妮-海瑟薇的新闻正相关

新浪财经讯 美国东部时间3月28日下午(北京时间3月29日早间)消息,好莱坞女星安妮-海瑟薇(Anne Hathaway)与“股神”沃伦-巴菲特(Warren Buffet)最近常被媒体放在一起,可不是他俩闹绯闻,而是有人发现只要海瑟薇有重大新闻见诸报端,巴菲特执掌的伯克希尔-哈撒韦公司 (Berkshire Hathaway)股价便会上涨。

美国导演Dan Mirvish在著名政治博客网站Huffington Post发布了他这个有趣的发现,“只要海瑟薇出现在头条,伯克希尔-哈撒韦公司的A股股价就会上涨”。他以海瑟薇最近最为出彩的2011年奥斯卡颁奖礼 主持秀为例,在2月27日(周日)奥斯卡颁奖前的最后一个交易日(25日)以及颁奖礼后第一个交易日(28日),伯克希尔-哈撒韦A股股价分别上涨 2.02%和2.94%。

Mirvish坦言,那或许并不全是海瑟薇主持奥斯卡的功劳,因为“股神”恰恰是在2月26日公布2011年度致股东信件,信中暗示他可能进行 更多重大收购。不过,他发现,海瑟薇与伯克希尔-哈撒韦A股股价的奇妙关联早已存在,2010年11月29日海瑟薇被宣布将主持2011年奥斯卡时,后者 的股价当日上涨0.25%。

若再往回追溯,更有趣的是,海瑟薇出演的5部电影首映日,伯克希尔-哈撒韦A股股价都是上涨。

2008年10月3日《瑞秋的婚礼》(rachel getting married)首映,股价涨0.44%;2009年1月5日《新娘大作战》(Bride Wars Open)首映,股价涨2.61%;2010年2月8日《情人节》(Valetine's day)首映,股价涨1.01%;2010年3月5日《爱丽丝梦游仙境》(Alice in Wonderland)首映,股价涨0.74%;2010年11月24日《爱情与灵药》(Love and Other Drugs)首映,股价涨1.62%。

“或许这是一种Hathaway效应。”Mirvish认为,海瑟薇与伯克希尔-哈撒韦A股股价之间的关联可能是自动化的,因为他们的名字中都 有“Hathaway”,而美国证券市场参与者的信息筛选系统会自动的将海瑟薇的新闻也抓取到伯克希尔-哈撒韦公司的新闻里面来。

美国CNBC财经电视台认为Mirvish的猜想有一定的合理性,因为英国《金融时报》今年1月曾报道,伴随华尔街高频交易兴起,路透社已向客 户提供一种“可供机器阅读的”新闻订阅服务,这项服务主要透过计算机自动从数以千计的新闻中透过“关键词”筛选,抓取出交易员可能关心的新闻,以辅助他们 制定投资策略。

若果真如此,伯克希尔-哈撒韦公司投资者们或许会更为喜爱海瑟薇,“股神”都可以考虑投资好莱坞电影咯。不过,这个有趣的想法并不见得能次次灵 验。好比新浪财经就发现,2006年6月30日,海瑟薇主演的《穿普拉达的恶魔》(The Devil Wears Prada)首映,当日伯克希尔-哈撒韦公司A股股价却微跌0.59%。(颜茜 发自美国纽约)

http://www.huffingtonpost.com/dan-mirvish/the-hathaway-effect-how-a_b_830041.html

Whatever you may think of how Anne Hathaway and her co-host James Franco did as hosts of the newer, younger, hipper Oscars, one thing appears to be certain: When Anne Hathaway makes headlines, the stock for Warren Buffett's Berkshire-Hathaway goes up. Think of Berkshire-Hathaway shares (BRK.A) as a really expensive version of the IMDb's StarMeter (which actually is designed to go up and down as actors make the news). But a bedrock member of the New York Stock Exchange? The evidence would indicate as much.

On the Friday before the Oscars, Berkshire shares rose a whopping 2.02%. And on the Monday just after the Academy Awards, they rose again, this time 2.94%. But it's not just an Oscar bounce, or something Warren Buffett may have said in the newspaper, or even necessarily something the company itself is doing (i.e. rumors afoot to buy Costco). Just look back at some other landmark dates in Anne Hathaway's still young career:

Oct. 3, 2008 - Rachel Getting Married opens: BRK.A up .44%

Jan. 5, 2009 - Bride Wars opens: BRK.A up 2.61%

Feb. 8, 2010 - Valentine's Day opens: BRK.A up 1.01%

March 5, 2010 - Alice in Wonderland opens: BRK.A up .74%

Nov. 24, 2010 - Love and Other Drugs opens: BRK.A up 1.62%

Nov. 29, 2010 - Anne announced as co-host of the Oscars: BRK.A up .25%

My guess is that all those automated, robotic trading programming are picking up the same chatter on the internet about "Hathaway" as the IMDb's StarMeter, and they're applying it to the stock market. Of course, this isn't necessarily bad news for the investor. After all, can you imagine what might have happened to Berkshire stock if Warren Buffett had appeared nude in Love and Other Drugs rather than Anne Hathway? Perhaps it's best if we don't think about it.

Is Warren Buffett the Next Harry Winston? Ask Anne Hathaway

Last week I wrote about the curious phenomenon known as "The Hathaway Effect" -- when Anne Hathaway is in the news, the share prices for Warren Buffett's Berkshire-Hathaway go up (most likely because of robo-traders reacting to the Hathaway name in the news). There was an international reaction to the story (includingBoingBoing, Time magazine and the evening news in Canada). But one of the more curious responses was from one of Berkshire-Hathaway's official blogs in Buffett's homebase of Omaha.

Last week I wrote about the curious phenomenon known as "The Hathaway Effect" -- when Anne Hathaway is in the news, the share prices for Warren Buffett's Berkshire-Hathaway go up (most likely because of robo-traders reacting to the Hathaway name in the news). There was an international reaction to the story (includingBoingBoing, Time magazine and the evening news in Canada). But one of the more curious responses was from one of Berkshire-Hathaway's official blogs in Buffett's homebase of Omaha.

In the "Berkshire-Hathaway Annual Shareholder Meeting" blog run by Omaha-based Borsheims jewelry store (which is owned by Berkshire-Hathaway), it reads:

The Omaha World Herald had a really fun and interesting article today about the connection between actress Anne Hathaway and Warren Buffett... Here's a link to the article:Wait Till She Names a Child Berkshire

I can think of another connection, too! Anne Hathaway likes to wear jewelry, and Berkshire Hathaway's Borsheims loves to sell jewelry! Shop our looks fit for an actress.

So come next Oscar season, will Warren Buffet be the next Harry Winston, decking out Hathaway and other Hollywood starlets in million-dollar jewels? If so, will they have to go to Omaha for a fitting at Borsheims or will Warren set up shop on Rodeo Drive? (I asked Anne Hathaway's publicist, Steven Huvane at Slate PR, for a response but he demurred.)

Among the other unintended consequence of "The Hathaway Effect" is that since writing about it, it appears to have become a self-fulfilling prophecy that proves my original point: On March 3, the first full trading day after the story got wide circulation last week, Berkshire-Hathaway's stock rose by 2.05%. I know some have commented that Berskire Hathaway stock goes up everyday anyway, but on the contrary: The day before, it was down .51%, and the day after it was down 1.40%.

Meanwhile, Anne Hathaway's IMDb STARMeter number shot up 85% in the last week (she's now #7 on the list). And out of full disclosure, perhaps it is worth noting that my own IMDb STARmeter rating rose by 39% in the last week, too. Now that's some Hathaway Effect!

The Warren Buffett And Anne Hathaway Trade

|

| Getty Images Anne Hathaway and Warren Buffett |

Anne Hathaway and Warren Buffett have recently been linked in the media—though not romantically, thank god.

No, this linkage is purely statistical.

Dan Mirvish over at Huffington Post spotted the following unusual data blip: Whenever Anne Hathaway's name appeared with any regularity in news stories, Berkshire Hathaway A shares rose in value.

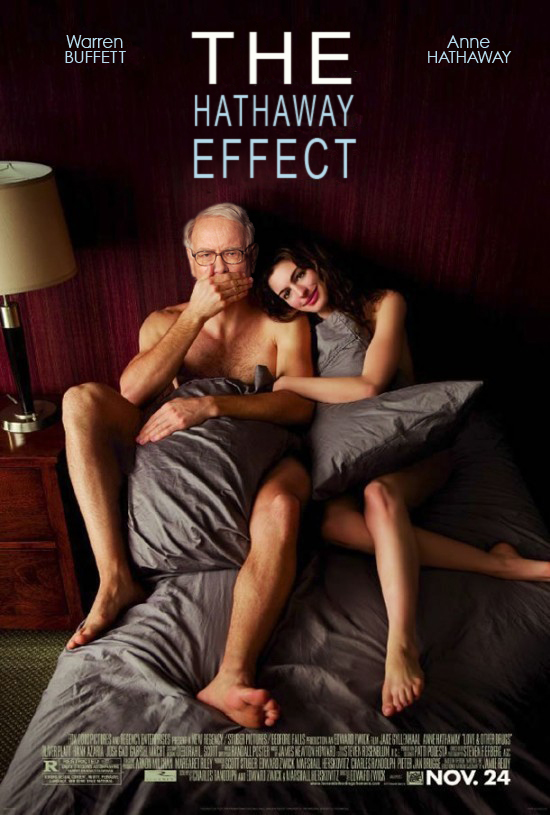

Mirvish's article is clever—and the genius/disturbing movie poster photoshop work contained therein is definitely worth the jump.

Mirvish humorously submits the following mini-table of rather official looking data for our consideration:

Oct. 3, 2008—Rachel Getting Married opens: BRK.A up .44%

Jan. 5, 2009—Bride Wars opens: BRK.A up 2.61%

Feb. 8, 2010—Valentine's Day opens: BRK.A up 1.01%

March 5, 2010—Alice in Wonderland opens: BRK.A up .74%

Nov. 24, 2010—Love and Other Drugs opens: BRK.A up 1.62%

Nov. 29, 2010—Anne announced as co-host of the Oscars: BRK.A up .25%

Writing for the FT's Alphaville, Tracy Alloway picks up the story—adding both additional comic relief and raising a relevant point: Namely, that the advent of machine readable data creates the opportunity to detect such correlations: Visible and invisible—legitimate and spurious.

Alloway points to the following, from the Financial Times this January:

"So-called 'machine readable news' services, such as the new Thomson Reuters product, have grown up in parallel with the emergence of high-frequency and algorithmic trading, which depend on lightning-fast delivery of data and news to traders specialising in such computer-driven trading strategies. Machine readable news systems use computers to "scrub" thousands of breaking news stories, prioritising their relevance for traders—often based on simple key words—and delivering them in a special feed. This provides traders with "signals" that are used to drive their strategies."

But what are the pitfalls of publishing a panoply of parameterized data?

In the Anne/Berkshire Hathaway test case, it's pretty clear that the 'correlation' is more—or less—than serendipitous: It's driven purely by chance, rather than by any fundamental underlying relationship among the data.

Unless, of course, the tin foil hat types are right—and the illuminati and the WTO really do run Hollywood and Wall Street.

Which may make you wonder: In the absence of brain-melting conspiracy, does casting such a wide net lead analysts to hyperventilate over 100 of every 10 genuine phenomena?

_______________________________________

Questions? Comments? Email us at NetNet@cnbc.com

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC

没有评论:

发表评论