在有关加强中非关系的辩论中,贸易关系往往归结于中国对非洲石油和矿物难以餍足的渴求。中国的朋友们表示,这种说法过于简单化,但本周公布的最新图表显示,这并非没有道理。

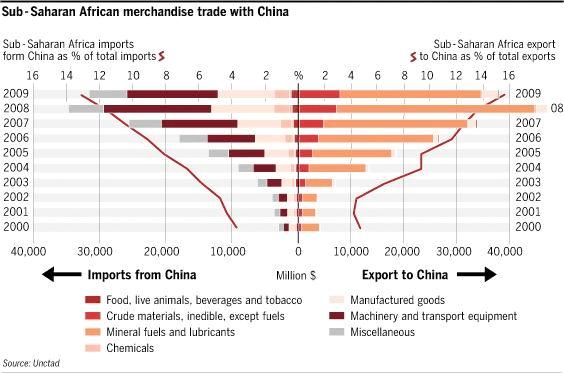

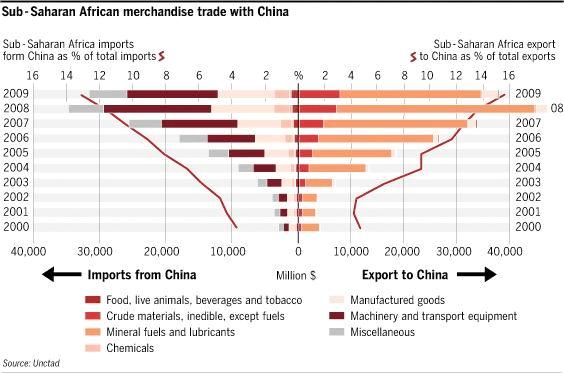

撒哈拉以南非洲地区出口至中国的产品比较单一:去年89%的出口产品为石油、矿物和其它原材料。过去十年间,出口额以令人惊讶的速度增长——从2000年的42亿美元,增至2009年的380亿美元——但初级产品在其中占据较高比重的局面从未改变。然而,人们对两件事情认识不足:一是大部分出口都集中在少数几个非洲国家,二是贸易本质来自相反方向。

总体而言,由于全球经济低迷的影响,中国与撒哈拉以南非洲地区去年的贸易额为696亿美元,低于2008年的820亿美元。今年中非贸易已有所反弹。

撒哈拉以南非洲地区从中国进口的商品额,通常低于出口到中国的商品额,但情况并非总是如此,而且两者之间的差距也不大:过去十年间,进口额在出口额的65%至105%之间。

从中国销往非洲的主要是制成品。许多中国消费品价格低廉,因此完全符合非洲的需求,而且有助于扩大非洲消费者可购买产品的范围:尤其是鞋类、家具、照明设备、纺织品、电子玩具和药品。

中国进口占据最大比例的国家是多哥、博茨瓦那和莱索托等小国——它们主要购买的是纺织品和服装。

但非洲的钱更多是花在购买机械和交通设备上。正如非洲开发银行(African Development Bank) 7月份的一份报告中所指出的那样,“这与中国企业在非洲基础设施领域(尤其是电信、道路建设和众多公共建筑领域)有着强大的业务有关”。许多中国公司之所以能够赢得建筑合同,都与可以获得本国国有金融机构的优惠融资有关。

就绝对值而言,南非是中国在非洲最大的进口国,包括电信设备、电脑以及其它商品——去年占到所有撒哈拉以南非洲地区进口总额的26%。

而且在非洲大型经济体当中,南非与中国这个亚洲强国之间的贸易关系最为均衡:去年该国出口的矿石和贵金属,占到了所有撒哈拉以南非洲地区向中国出口总额的15%。

最大的出口国是安哥拉,该国主要出口产品是石油。第二大出口国苏丹亦是如此——其60%的出口产品销往中国,使得该国成为最依赖中国的国家之一。自上世纪90年代以来,无论在苏丹还是在安哥拉,中国国有企业在开发能源领域方面都扮演着关键角色。

其它主要出口国还有刚果民主共和国(Democratic Republic of Congo)、刚果共和国(Republic of Congo)和赤道几内亚(Equatorial Guinea)——单单这6个国家,就占到了撒哈拉以南非洲地区对中国出口的86%。6国以外的非洲国家的对华出口明显减少,表明中国对非洲矿物的攫取集中在少数几个国家,还没有成为席卷整个非洲大陆的趋势。

尽管石油和矿物在非洲出口中占据较高比例,但随着去年制成品出口比例从本世纪初的4%上升至8%,石油和矿物出口比例大幅下降。不过大多数制成品仍与生产以铜、铁、银和铝等为原材料的产品有关。

许多非洲国家希望生产价值更高的产品,并鼓励中国向非洲工业园区和经济特区进行更多投资。然而,根据维基解密(WikiLeaks)公布的一份美国外交电报,美国一位高官将进入非洲的中国描述为“一个邪恶的经济竞争对手,没有任何道德可言”。如果这种说法是准确的,中非贸易平衡就不太可能发生改变。

译者/何黎

http://www.ftchinese.com/story/001036128

In the debate over strengthening ties between China and Africa, trade relations are often boiled down to China’s insatiable hunger for African oil and minerals. China’s friends say this is a gross oversimplification, but the latest chart of the week (after the break) shows it’s not unreasonable. Exports from sub-Saharan Africa to China lack diversity: 89 per cent last year were oil, minerals and other raw materials. The value of exports has grown at a staggering rate over the past decade - from $4.2bn in 2000 to $38bn in 2009 - but the high proportion of primary goods has not changed. Two things, however, get less recognition: the high concentration of exports from just a few African countries, and the nature of the trade in the opposite direction.

Overall, commerce between China and sub-Saharan Africa last year was $69.6bn, down from $82bn in 2008 due to the effects of the global economic downturn. It is already bouncing back this year. The value of sub-Saharan Africa’s imports from China tends to be lower than the value of its exports to China, but not always and not by much: over the past decade imports were worth between 65 per cent and 105 per cent of the value of exports. One key part of what’s heading to Africa from China is manufactured goods. The low prices of many Chinese consumer goods mean they fit neatly with African demands and help broaden the range of products African consumers can buy: particularly footwear, furniture, lighting, textiles, electronic toys and pharmaceuticals. The countries with the largest proportion of imports coming from China are the tiny economies of Togo, Botswana and Lesotho, which are buying mainly fabrics and clothing. But more African money is spent on machinery and transport equipment. As the African Development Bank noted in a paper in July, that is “linked to the strong presence of Chinese firms in the infrastructure sector, specifically in telecommunications, road construction and [the] construction of numerous public buildings”. Many of those Chinese companies have won building contracts linked to concessional financing from state-owned Chinese financial institutions. In absolute terms South Africa is the biggest importer from China, bringing in telecoms equipment, computers and other goods that accounted for 26 per cent of all sub-Saharan imports last year. Of the biggest economies, South Africa also has the most balanced trade relationship with the Asian superpower: its exports of ores and precious metals helped it to contribute 15 per cent of all sub-Saharan exports to China last year. The largest exporter is Angola and the majority of its shipments are oil. The same is true for Sudan, the second biggest exporter, which sends over 60 per cent of its exports to China, making it one of the most reliant on the Asian country. In both Sudan and Angola, Chinese state-owned companies have played a crucial role in developing the energy sector since the 1990s. The list of top exporters is completed by the Democratic Republic of Congo, the Republic of Congo, and Equatorial Guinea - and those six alone account for a remarkable 86 per cent of sub-Saharan exports to China. Outside that group shipments fall off sharply, demonstrating how China’s mineral grab is concentrated in just a few places and is not yet a pan-continental trend. In spite of the high proportion of oil and minerals in the export figures, the share declined marginally as Africa’s manufactured exports rose to 8 per cent of the total last year, up from about half of that proportion at the start of the decade. But most manufacturing is still about making products derived from raw materials such as copper, iron, silver and aluminium. Many African governments would like produce higher-value products - and to encourage that China is investing more in African industrial parks and special economic zones. However, one senior US official has described China in Africa as “a pernicious economic competitor with no morals”, according to a WikiLeaks cable. If that is accurate, the China-Africa trade balance is unlikely to shift.

没有评论:

发表评论